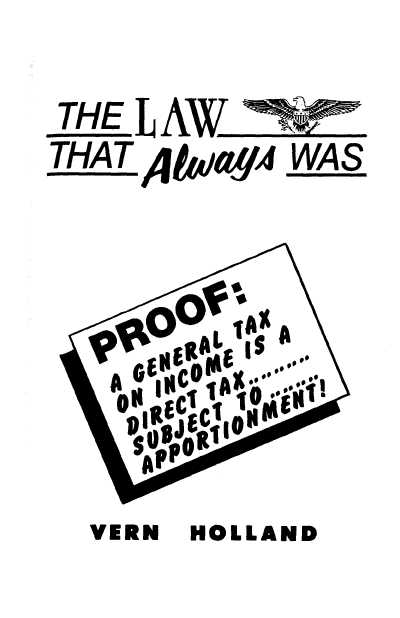

THE LAW THAT ALWAYS WAS

Copyright 1987 Vern Holland

F.E.A. BOOKS

8141 E. 31st St.. Suite F Tulsa. OK 74145

ALL RIGHTS RESERVED

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means -- electronic, mechanical, photocopy, recording, or otherwise -- without the express prior permission of F.E.A. Books, with the exception of brief excerpts in magazine articles and/or reviews.

Printed in the United States of America

* * *

This book is designed to provide the author's findings and opinions based upon research and analysis of the subject matter covered. This information is not provided for purposes of rendering legal or other professional services, which can only be provided by knowledgeable professionals on a fee basis.

Further, there is always an element of risk in standing up for one's lawful rights in the face of an oppressive taxing authority backed by a biased judiciary.

Therefore, the author and publisher disclaim any responsibility for any liability or loss incurred as a consequence of the use and application, either directly or indirectly, of any information presented herein.

To Megan, Ashley, and Nicholas

SPECIAL THANKS

The thousands of hours of research that have gone into this book would never have occurred had it not been for the support and encouragement of several special people. First, I would like to thank Billie Murdock and Larry Becraft whose devotion to our cause and willingness to share the fruits of their personal research helped me put the pieces of this puzzle together. Secondly, Kevin O'Brien made invaluable contributions both as a sounding board during the research phase and as a proof reader while the book was being physically put together. And finally, thanks to Dave Mauldin who pulled cases and helped with the editing. Without this team effort, the hidden flicker of truth contained within these covers might have died and been lost forever. Now the hope is that this truth might be fanned into a bonfire loosing the chains of government.

Vern Holland Tulsa, Oklahoma September 24, 1987

TABLE OF CONTENTS

Page

TABLE OF CONTENTS................................... i

INTRODUCTION........................................ v

Chapter I

CONFUSION IN THE COURTS........................... 1

Chapter II

"DIRECT" AND INDIRECT TAXES. AS

AUTHORIZED BY THE U.S. CONSTITUTION

EXPLAINED AND DISTINGUISHED....................... 7

Constitutional Convention Not A

Legislative Body................................ 15

Chapter III

A GENERAL TAX ON INCOME HAS ALWAYS

BEEN RECOGNIZED. DESIGNATED. AND

DESCRIBED AS A DIRECT TAX

THE HISTORICAL EVIDENCE........................... 23

The Beginnings.................................. 24

The Eighteenth Century.......................... 27

The Question of Whether a General Tax on Income is a Direct Tax Cannot Be Deemed Settled Until It is Decided in Accordance with the Plain Meaning of the Constitution and the Dictates of Common Sense in a Case

Directly Presenting the Question................ 38

Articles of Confederation....................... 41

The Compromise of the New Constitution.......... 48

Chapter IV

IS AN INCOME TAX A "DIRECT TAX" WITHIN THE

PROVISIONS OF THE FEDERAL CONSTITUTION?........... 55

What Has the Practical Construction Placed

Upon the Constitution by Men Contemporary

With its Formation. Who Were in Congress

From 1790 to 1815?.............................. 85

Chapter V

HYLTON v. UNITED STATES

United States Supreme Court

3 U.S. (3 Dall.) 171 (1796)....................... 93

Trial Before the Circuit Court.................. 95

Argument in the United States Supreme Court..... 99

Apportionment As 'An Express Limitation'........ 110

Albert Gal latin and Secretary Wolcott........... 112

States vs. Territories.......................... 119

Hylton and Stare Decisis........................ 123

Chapter VI

THE CIVIL WAR INCOME TAX.......................... 125

The Constitutionality of the Various Civil War Tax Acts Considered by the

Supreme Court................................... 135

Springer v. United States

Supreme Court of the United States

102 U.S. 586 (1880)............................. 138

Chapter VII

POLLOCK v. FARMERS' LOAN AND TRUST CO.

United States Supreme Court

157 U.S. 429 (1894). reh. 158 U.S. 601 (1895)..... 147

The Founding Fathers Understood

the Language They Used.......................... 159

General Tax on Income Distinguished From

Certain Indirect Taxes Measured by Revenue...... 163

Chapter VIII

THE SIXTEENTH AMENDMENT........................... 169

Chapter IX

SURPRISE!!!

THE SIXTEENTH AMENDMENT

DID NOT AMEND THE CONSTITUTION

Brushaber v. Union Pacific Railroad Co.

United States Supreme Court

240 U.S. 1 (1915)............................... 179

Chapter X

RESTORING

THE LAW THAT ALWAYS WAS

Cutting the Thread of the

Springer Case................................... 197

Chapter XI

CONCLUSION........................................ 217

APPENDICES

Table of Contents................................. 221

Appendix A........................................ 223

Appendix B........................................ 229

Appendix C........................................ 231

Appendix D........................................ 233

Appendix E........................................ 235

INTRODUCTION

THE LAW THAT ALWAYS WAS provides an historical look into the subject of Federal income taxation from a constitutional perspective. The book's underlying purpose is to provide useful ammunition to those individual Americans who have taken upon themselves, at great sacrifice and expense, the personal endeavor to aid in the restoration of this great nation (via the elimination of the Federal income tax), to the sound political and economic foundations upon which the United States of America was established, exactly 200 years ago.

It is a privilege to make THE LAW THAT ALWAYS WAS available in the year 1987, the bicentennial anniversary of the birth of the United States Constitution, especially since the main focus of THE LAW THAT ALWAYS WAS is to prove that today's Federal income tax, as applied and enforced, is contrary to the clear intent of the framers of that great document.

In this 200th year of our great Republic, it is fitting for us to reexamine, or more appropriately, to reaffirm the principles upon which our Federal system was established under the Constitution. In examining these principles, it is important to recognize that there exists today, just as in 1787. two great forces which influence our constitutional system, each advancing its own ideological agenda.

The first great force influencing our constitutional system, which currently appears to hold the minority view, believes that the Constitution should be read, Interpreted and applied in light of the clear intent of the framers. This group views the document as timeless, written to withstand the forces of social and political change. Those with the conservative point of view believe that the values represented in the formation of the Constitution must be preserved, if the nation is to survive another centennial anniversary. They also largely believe that the Constitution, along with other documents of the period, were divinely inspired, and. like the Holy Bible, should be read literally, without "modern interpretation."

The second of the two great forces influencing our constitutional system currently enjoys the sanction of a majority of the Supreme Court, a majority of the entrenched ideologues in both Houses of Congress, and in the various institutions of American society (i.e.. the public school system, the news media, many religious denominations, etc.). They view the Constitution as either an antiquated document, or an evolving document (not necessarily evolving through the amendment process, but particularly evolving according to the social and political needs of the day). Their great advocate has been the United States Supreme Court, which, over the years, has seen fit to approve FDR's "New Deal" social welfare programs, under the auspices of the general welfare clause; has forced the integration of the State public school systems (forced busing), under the blanket of the Equal Protection Clause; has approved the murder of unborn babies, under the guise of the right to privacy; and has prohibited the use of prayer in schools, under the guise of Freedom of Religion. True constitutionalists have suggested that our Founding Fathers would have largely scoffed at such ideas, as these, being adopted by the high Court under a supposed sanction of the Constitution.

The advocates of the liberal point of view suggest that

the Framers. living in a different time, could not have envisioned the needs of our modern society, nor the changes which would occur over two centuries. The advocates of a strict construction of the intent of the Framers of the Constitution hold to the position that these were men of great vision, who recognized that in order for the people of America to live in harmony, they must live under a system of high moral values, and the Constitution is the thread which most effectively serves as the benchmark for maintaining the ideal. Without this ideal, a majority would be able to discard the absolutes and the values which have been responsible for nurturing and developing the greatest nation the Earth has ever known.

THE LAW THAT ALWAYS WAS begins by pointing out that modern Federal Appellate Courts cannot agree as to the source of the Congress' power to impose taxes upon incomes. This confusion is evidenced by the fact that some of the Federal Appellate Courts say that the income tax is an indirect tax authorized by Article I. Section 8, Clause 1 of the Constitution; while others claim that the income tax is a direct tax, relieved from the rule of apportionment by the Sixteenth Amendment; and still others claim that the question of whether the income tax falls under the direct or indirect class was eliminated by the unqualified language of the so-called "income tax amendment" because it removed any distinction which might have existed between the two great classes, when dealing with the subject of income taxation. Thus today's Courts say that the Federal income tax is an indirect tax, a direct tax and neither. THE LAW THAT ALWAYS WAS is written to address this confusion amongst the Courts and to prove, from an historical perspective that (1) the people who comprised the citizens of the several States, at the time of the adoption of the Constitution recognized an income tax as a direct tax; (2) the most respected of the political and economic writers of the period understood an income tax to be a tax of the most direct

kind; and (3) from as early in our constitutional history as the case of Hylton v. United States (1796), through the Civil War, onward through to the present, forces who are jealous of the minor limitations placed upon the taxing powers of Congress have attempted, with reasonable success, to cloud the meaning of the terms "direct tax" and "direct taxes" as used by the Framers of the Constitution. However, in spite of attempts to destroy the meaning of these terms and despite attempts to disguise the historical record, the evidence remains.

THE LAW THAT ALWAYS WAS proves that today's Federal income tax, at least in its application to the income of the Citizens of the States, is not based upon any new power granted by the Sixteenth Amendment. The Supreme Court, in Brushaber v. Union Pacific Railroad Co.. held that the effect of the amendment was to operate as a bar to advancing, in the future, an argument similar to that advocated by Charles Pollock, in Pollock v. Farmers Loan & Trust, wherein it was held that a tax upon the income arising from investments in real estate and personalty was, in effect, a direct tax upon those investments, because of the resulting burden placed upon the sources of the income, and thereby must be apportioned among the several States according to the direct taxing clauses of the Constitution. Even though counsel for both Brushaber and the Government argued that the amendment authorized an unapportioned direct tax upon incomes, the Court correctly refused to adopt such an interpretation, because to do so would cause irreconcilable conflict between the Sixteenth Amendment and the direct tax clauses of the Constitution.

THE LAW THAT ALWAYS WAS proves that the only time the question of the validity of an unapportioned tax upon professions, employments, and occupations (labor) has ever been before the Supreme Court was in 1880, where William M. Springer, a member of Congress, refused to pay the income tax imposed in 1865 by the Radical Republicans then occupying Congress during the Civil War (a.k.a. The War of Northern Aggression). In that case, the Court sustained

the tax as an indirect tax based upon the grounds that (1) they felt that the only direct taxes were those which could be fairly apportioned among the States; (2) they felt that an income tax could not be fairly apportioned because of the inequality of populations and incomes in the several States; and (3) the Congress, in nearly 100 years, had never imposed a tax upon incomes as a direct tax. The first two points relied upon were based upon the dictum of Hylton v. United States, wherein the Supreme Court held that a tax upon carriages was an indirect tax because the tax was based upon the use and not upon the ownership of the property. The Springer Court was relying upon the dictum of Hylton where Justices Chase, Paterson and Iredell, in separate opinions, each speculated that perhaps the only direct taxes contemplated by the Constitution were those upon real estate and capitation taxes. This unnecessary speculation by the 1796 Court was actually inconsistent with the point actually decided in that case.

THE LAW THAT ALWAYS WAS proves that the Hylton case was a "sham," "set-up" case, where Alexander Hamilton and his fellow Federalists conspired with Hylton to advance a contrived case where the parties would stipulate to a false set of facts. Hylton agreed to claim that he owned 125 carriages in spite of the fact that he owned only one. The government attorneys along with Hamilton argued both sides of the case with the intent of presenting the case in such a light that the government position would be given the most favorable light by the Court.

THE LAW THAT ALWAYS WAS proves that the dictum in Hylton, which became the building block in reaching the conclusion that a general tax on incomes was nothing but an indirect tax, was not based upon any reasonable construction of the theory of taxation held by the Framers of the Constitution, the political and economic writers of the period, nor was it supported by the practice of the several States before or after the adoption of the Founding document, nor was it supported by the

understanding of the Inhabitants of the newly united States at that time.

THE LAW THAT ALWAYS WAS proves that the constitutionality of the Federal income tax hangs on the thread of the integrity of Springer v. United States, which was based upon the noncommitting speculation (dictum) of Hylton v. United States, a case of questionable origin, which turned a blind eye to the then current practice of the several States, and the general understanding of those who comprised the People of the United States of America.

The purpose of this book is to reveal the truth about the source of the terms "direct tax" and "direct taxes", as used in the Constitution, and intent of the use of those words. These principles are then applied to today's income tax, as imposed upon the general income of citizens of the several States. It is the sincere prayer of the author that the information in this book will help to educate patriotic God fearing Americans as to the TRUTH about the THE LAW THAT ALWAYS WAS.

Chapter I

CONFUSION IN THE COURTS

The practical construction of the Constitution, as relates to taxation, under which the United States Government has been acting since 1913, seems to proceed upon the idea that the "direct tax" clauses of the Constitution embrace only capitation or poll taxes and taxes upon lands, and that every other species of governmental assessment, including income taxes, that can be devised by the ingenuity of those who are solicitous to obtain money for the uses of the government is either a "duty." an "impost," or an "excise." Either this is the assumption, or else it is supposed that the Sixteenth Amendment authorized taxes which Congress is not required by the Constitution to lay, either according to the rule of apportionment or the rule of uniformity, but which it may lay under either of those rules, or under any other rule, at pleasure. For, it is to be remembered, that the Constitution, after having granted the general power of laying Taxes, Duties, Imposts, and Excises, has directed that capitation and all other direct taxes shall be laid by apportionment among the States according to the census; and that all duties, imposts, and excises shall be laid by the rule of uniformity; that is to say, so that the rule of assessment shall be the same in all parts of the Union, however various may be the total amounts which are collected in different States.

THE LAW THAT ALWAYS WAS

In fact, there is absolute chaos in the rulings of the United States Circuit Courts as to the effect of the Sixteenth Amendment of the United States Constitution even to the extent of overruling the United States Supreme Court.

The case of Ficalora v. C.I.R., 751 F.2d 85 (2nd Cir. 1984). states that the case of New York ex rel. Cohn v. Graves, 300 U.S. 308 (1937) in effect overruled Pollock v. Farmer's Loan and Trust Co.. 157 U.S. 429 (1894), reh. 158 U.S. 429 (1895), and in so doing rendered the Sixteenth Amendment unnecessary, when it sustained New York's income tax on income derived from real property in New Jersey. This case obviously said the Sixteenth Amendment is absolutely worthless to our Constitution and takes the position that an income tax is an indirect tax.

The Court in Simmons v. United States. 308 F.2d 160 (4th Cir. 1962). took the position that the Sixteenth Amendment relieved direct taxes upon income from the apportionment requirement of Article I of the Constitution.

The Court states in Keasbey & Mattison Co. v. Rothensies. 133 F.2d 894 (3rd Cir. 1943). that an "income tax" is a direct tax upon income.

The Court in White Packing Co. v. Robertson. 89 F.2d 775 (4th Cir. 1937). states that the tax is. of course, an excise tax, as are all taxes on income.

The Court states in Lonsdale v. C.I.R., 661 F.2d 71 (5th Cir. 1981). that the requirement to apportion a direct tax on income was eliminated by the Sixteenth Amendment.

Other Courts holding that the Sixteenth Amendment eliminated the requirement that direct income taxes be apportioned among the states are United States v. HcCarty, 665 F.2d 596 (5th Cir. 1982); Parker v. C.I.R., 724 F.2d 469 (5th Cir. 1984); Prescott v. C.I.R., 561 F.2d 1287 (8th Cir. 1977); Funk v. C.I.R., 687 F.2d 264 (8th Cir. 1982); Broughton v. United States, 632 F.2d 707 (8th Cir. 1980); Fairbanks v. C.I.R., 191 F.2d 680 (9th Cir. 1951); United States v. Stillhammer, 706 F.2d 1072 (10th Cir. 1983);

United States v. Lawson. 670 F.2d 923 (10th Cir. 1982).

The Court in United States v. Turano. 802 F.2d 10 (1st Cir. 1986), states that the prosecuting attorney incorrectly stated that the 16th Amendment had eliminated the Constitutional distinction between direct and indirect taxation since the Sixteenth Amendment only eliminated the distinction for income taxes.

A summary of the foregoing cases shows that the income tax is an indirect tax. a direct tax. and neither. Many of the above cases state that the Sixteenth Amendment authorized a "direct tax" on income, without apportionment, which in effect would overrule the United States Supreme Court in Brushaber v. Union Pacific Railroad Co., 240 U.S. 1 (1915) which stated that a "direct tax" could not be relieved from the regulation of apportionment. The Court in the Brushaber case was called upon to determine the meaning and effect of the Sixteenth Amendment. Counsel for Frank Brushaber advanced the argument, among others, that the Sixteenth Amendment authorized only a particular character of direct taxes without apportionment. Solicitor General Davis and Attorney General Gregory filed a brief for the United States, and took the position that the Sixteenth Amendment recognized that an income tax was a "direct tax" but removed the regulation of apportionment as follows:

I. Income taxes, at least when laid on income derived from real or personal property, are direct taxes, and therefore not subject to the uniformity rule. EXPRESSLY prescribed by the Constitution.

(a) It is settled that the uniformity requirement of clause 1 of section 8 of Article I of the Constitution, is limited to duties, imposts, and excises, and does not apply to direct taxes. (cites omitted) And the Pollock case, finally determines that a tax on income derived from either real or personal property is a direct tax. ...

(b) Apportionment being restricted to direct

taxes only, the Sixteenth Amendment, in removing that restriction, recognized any tax upon income "from whatever source derived" as a direct tax, and as such subject to the apportionment rule unless specially exempted. Appellee brief, pp. 11 - 12.

Both parties, therefore, were arguing that the Sixteenth Amendment removed the requirement of apportionment on some, if not all, direct taxes on income. This, of course, was the intent of Congress, which will be dealt with later. The Court destroyed these contentions at 240 U.S. at pp. 10-12:

"We are of opinion, however, that the confusion is not inherent, but rather arises from the conclusion that the 16th Amendment provides for a hitherto unknown power of taxation; that is, a power to levy an income tax which, although direct, should not be subject to the regulation of apportionment applicable to all other direct taxes. And the far-reaching effect of this erroneous assumption *** "But it clearly results that the proposition and the contentions under it, if acceded to, would cause one provision of the Constitution to destroy another; that is, they would result in bringing the provisions of the Amendment exempting a direct tax from apportionment into irreconcilable conflict with the general requirement that all direct taxes be apportioned. Moreover, the tax authorized by the Amendment, being direct, would not come under the rule of uniformity applicable under the Constitution to other than direct taxes, and thus it would come to pass that the result of the Amendment would be to authorize a particular direct tax not subject either to apportionment or to the rule of geographical uniformity, thus giving power to impose a different tax in one state or states than was levied in another state or states.

Could anything be clearer? The Sixteenth Amendment cannot relieve a "direct tax" from apportionment because Article I. Section 9. Clause 4 and Article I. Section 2. Clause 3 mandates that all "direct taxes" be apportioned!

Robert L. Zimmerman, Assistant U.S. Attorney, in the case of United States v. Stahl, C.A. No. 85-3069. Ninth Circuit, in his brief filed September 6, 1985, took the position that the income tax is an excise, and therefore, the Sixteenth Amendment is not the basis for Congress' power to levy direct income taxes on income from labor, but it is the basis for a direct nonapportioned income tax on property and income from personal investment.

Then there is a report being circulated from the Congressional Research Service, Library of Congress, by Howard M. Zaritsky, Legislative Attorney, American Law Division, Report No. 80-19 A, Some Constitutional Questions Regarding The Federal Income Tax Laws, which states at CRS-2:

"The status of the income tax has not always been clearly determinable from the decisions of the United States Supreme Court, though for the past sixty-four years the Court has taken the view that the Federal income tax is an indirect tax authorized under Article I, Section 8. Clause 1 of the Constitution, as amended by the Sixteenth Amendment to the Constitution. [Emphasis added]

Yes, now we have the Government stating that the Sixteenth Amendment amended Article I, Section 8, Clause 1 of the Constitution.

It is quite apparent that the following issues must be re-examined.

(1) What are "direct" and indirect taxes, as authorized by the United States Constitution?

(2) Does the historical evidence support a general tax on income as being a direct or indirect tax?

(3) Is a general tax on income a direct tax in the constitutional sense?

(4) What was the Congressional intent with the Sixteenth Amendment?

(5) Did the Sixteenth Amendment change the Constitution?

Chapter II

"DIRECT" AND INDIRECT TAXES AS AUTHORIZED BY THE U.S. CONSTITUTION

EXPLAINED AND DISTINGUISHED

It is indisputable that the Constitution plainly recognizes the division of the Federal taxation which it authorizes into two great classes, and provides for the imposition of these two great classes of taxes respectively, upon entirely different bases. The original taxing clauses of the Constitution of the United States are:

"Representatives and direct Taxes shall be apportioned among the several States which may be included within this Union, according to their respective Numbers..." Art. I, Sec. 2. Cl. 3.

"The Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States; but all Duties, Imposts and Excises shall be uniform throughout the United States..." Art. I, Sec. 8, Cl. 1.

"No capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or Enumerated

herein before directed to be taken." Art. I, Sec. 9. Cl. 4.

The class of duties, imposts and excises, which it regards as indirect taxes, must be uniform throughout the nation. The other class, which it regards as direct taxes, must be apportioned among the several States in proportion to their representation in the popular branch of Congress; which representation is based upon population, as ascertained by the census.

These two measures of taxation are radically variant in their application to the individual taxpayer, in respect of the amount required of him, so that Congress in imposing a tax has no option as to which of the two measures shall be applied to it. To whichsoever of the two classes the tax belongs, the measure prescribed for that class must be followed in order for the tax to be valid, and no one tax can possibly be made to fit both measures.

It appears that the notion has come to exist among many that Congress is the first, last and final judge in matters of taxation, and that admitted injustice, or any tyranny exercised by Congress on this subject could be redressed only by the people acting in their political character. This idea has grown from the very small beginning of a tax laid on carriages by the Act of Congress of 1794, which the Supreme Court of that time thought, with great doubt and hesitation, was not a direct tax within the meaning of the Constitution. That lav made no provision for taxing Incomes. And so the effect of the decision was thought to be that if a tax on carriages was not a direct tax, a tax upon anything else excepting what, without any stated reason for the difference, some members of Congress and of the Court of that time thought was the only subject of direct taxation, viz., land and polls, was not a direct tax. The decision referred to was made in 1796.

After a lapse of nearly seventy-five years (the

carriage tax having been soon repealed) cases arose under the war impositions of Congress, enacted in 1861 and the years following. A General Tax on Incomes had never been imposed by Congress until the War of Northern Aggression, when a tax of twenty millions of dollars in the whole was laid upon the several States according to population, to be collected out of land alone; but with the provision that the States might assume the payment of the tax, and collect it in their own way. The same Act of Congress imposed a tax on a great variety of occupations under the heads of licenses, trades, transportation, etc., and, for the first time in the history of the Government, upon personal incomes. During the whole seventy years and upwards after the Constitution was adopted no question did or could arise in respect of the constitutional character of a Genera] Tax on Incomes. The only action of Congress that could possibly affect the question was the Act of 1794, before mentioned, taxing carriages, which tax was upheld as not a direct tax. with much doubt and hesitation.

The acts of 1861, and subsequent war-time acts, did, for the first time, undertake to impose a tax on personal incomes, as falling within the category of "duties, imposts and excises," which the Constitution authorized Congress to lay without regard to the population and representation of the States, provided only that they should be "uniform throughout the United States." The Constitution also provided that "representation and direct taxes shall be apportioned among the several States... according to their respective numbers," adding to the free persons, three-fifths of all other persons excepting Indians, -meaning, of course, the slaves. And the Constitution also provided that "no capitation or other direct tax shall be laid unless in proportion to the census." These acts of 1861, and the following ones of the war-time were upheld by the Supreme Court in Springer v. United States, 102 U.S. 586 (1880) (there are other cases, however, they can fairly be distinguished, as we

shall provide later in this work), as justifying a tax on personal incomes, not apportioned among the States, according to population. The law under which the Springer case arose was soon repealed, and no income-tax was again attempted until 1894.

There had been no personal income tax in the whole constitutional history of the United States for the seventy years of its experience of the urgent needs of more revenue, both in times of peace and Mar. The Supreme Court, in the Pollock v. Farmers Loan & Trust. 157 U.S. 429 (1894), reh. 158 U.S. 429 (1895). held that taxes imposed by Congress upon personal incomes or other property as such, were direct taxes, and, if imposed at all, must be imposed upon the people of the States according to their respective populations. Ex-Senator George Franklin Edmunds, of Vermont, elected to the United States Senate in 1866, serving successive terms until his resignation in 1891, was one of the foremost authorities on constitutional law, and as counsel for the appellants in the Pollock case, stated:

"It is curious and interesting to note that in the very learned, ingenious and exhaustive brief of the Attorney-General of the United States (than whom there is no better lawyer in the country) defending the law, there are only two or three pages of the whole ninety-nine devoted to suggesting, even, that the true meaning (were the matter res nova) of the Constitution could warrant the imposition of a personal income-tax otherwise than by apportionment among the States according to population as provided in the Constitution." The Forum. Salutary Results Of The Income-Tax Decision. July, 1895, p. 515.

To the Founding Fathers, the primary purpose of apportionment was to block the central government from using the power of direct taxation -- except in times of

great national emergency. The barrier was not in the formula of distributing the tax load among the states, but in the procedure for doing so. To lay a direct tax, Congress had to do certain things that no government wants to do. Since each tax is a separate project, each must be written into a revenue act. The purpose and the amount of the tax must be clearly stated. It then must be debated and voted upon. When the tax is collected, the revenue act expires, and the door to more money is closed. How different this is from the ongoing power of general taxation, under which the purpose is seldom known, the amount is always in doubt, and the process is endless. The rule of apportionment, therefore, was the greatest restraint on the power and reach of government that had yet been devised by man, and it is little wonder that it became a thorn in the side of federal politicians in the years to follow.

The builders of the political and social state composing the Union evidently intended and endeavored to make the principles and practice of taxation plain. There could have been no purpose of equivocation or concealment. There was none. The danger and the injustice of allowing the force of mere numbers to impose taxes which they should not bear themselves in due proportion, by any scheme that might be invented, upon the minority of the people of the States were perfectly understood. And so the relative equality of representation and taxation as such - just as it then was in many and still is in several States - was distinctly and emphatically provided for in the Constitution, - affirmatively by the provision that "representation and direct taxes shall be apportioned among the several States which may be included in this Union according to their respective numbers," and negatively, by the prohibition that "no capitation or other direct tax shall be laid unless in proportion to the census." Those great architects and builders of government well knew - better, perhaps, than we do in these days of much apparent, and some real sympathy with

doctrines and practices destructive of liberty and social order when the point "where virtue stops and vice begins"

has become obscure - that the rule of taxation should not and could not safely be left to the unlimited caprice, prejudice or selfishness of mere majorities represented in Congress.

An active and progressive people must have money for the common purposes of administration, - "to provide for the common defence and general welfare of the United States," as the Constitution so happily puts it. To this end, in addition to the provision for direct taxation as before stated, the Constitution provided that Congress should have "power to lay and collect taxes, duties, imposts and excises, ...but all duties, imposts and excises shall be uniform throughout the United States." Thus, the whole scheme for raising money by taxation was complete. On the one hand, taxes that bore directly upon the citizens must be apportioned among the States according to population, and on the other hand taxes in the form of "duties, imposts and excises," that would bear upon citizens only in proportion and according to the occupations and transactions they might choose to engage in, might be laid upon all equally and everywhere. The patriotic men who established this great government knew that unrestrained and unregulated taxation had been, in all the experiences of the world, the chief instrument of tyranny, and that while it was indispensable to the existence of the nation, it was not the less necessary that it should be kept within definite bounds.

The United States Government has the whole range of voluntary social and business activities left open for taxation, and the whole property of the country, real, personal and mixed, is left subject to taxation by the just and safe rule originally declared, according to representation - that is, by taxation, that those who impose it are, with their own people in their several States, to share in the burden.

The Government is not the state. It is only the agent

of the state, and it must act within the limits of its authority. If it acts beyond this, it becomes a usurper, and practices tyranny. The comparison of the governmental tyranny of a single despot, or even of a small body of persons, with the tyranny of the majority of a people, unhappily shows that the tyranny of the mob or commune, or any other tyranny of mere numbers, is far worse than any other while it continues.

If this assumption and reasoning may seem, to anyone, extravagant and unwarranted, his attention is respectfully asked to the following expression of opinion on this subject by the United States Supreme Court, as given through Justice Miller in the celebrated case of Loan Association v. Topeka. 20 Wall. 655 (18774) at page 662:

"It must be conceded that there are rights in every free government beyond the control of the State. A government which recognised no such rights, which held the lives, the liberty, and the property of its citizens subject at all times to the absolute disposition and unbounded control of even the most democratic depository of power, is after all but a despotism. It is true it is a despotism of the many - of the majority, if you choose to call it so - but it is none the less a despotism." [Emphasis added]

The unbridled power of the federal Government to impose taxation upon a citizen's property or income, within the several States, as an indirect tax, thereby transferring their wealth, for whatever the majority in Congress deems to be for the "general welfare," is the single most destructive form of tyranny this nation has ever known.

It has been decided by the highest authority, the United States Supreme Court, in the Brushaber case, previously cited, that the Sixteenth Amendment cannot relieve a direct tax from the regulation of apportionment. Circuit Court cases, many of which are cited above, have held that a General Tax on Income is a direct tax. The

Brushaber case has not been overruled, therefore, it is controlling. The burden is to demonstrate that a General Tax on Income is a "direct tax".

In one sense, all or almost all taxes are direct, i.e., there is an obligation directly imposed upon some one to pay them to the official appointed to receive them. The merchant who imports goods from abroad is directly compelled to pay the duty or impost upon them, to the Collector of Customs at the port. The manufacturer or producer of articles subjected by law to an excise tax is obliged directly to pay such tax to the Collector of Internal Revenue in his district; and such, we think will, upon examination, be found to be the practical status, through nearly the whole range of the duties, imposts and excises, referred to by the Constitution, and which, indisputably, it classifies as indirect taxes.

It cannot be disputed, that at the time of the adoption of the Constitution, and for a long time previously, there was an understanding, substantially universal, in this country, in England, and in other parts of Europe, that taxes were appropriately divisible into two great classes, direct and indirect, and that in discussions upon the subject of taxation, by political economists and others, taxes were accustomed to be spoken of and thus classified.

It is likewise indisputable that in such discussion, taxes upon consumable commodities, or what are called taxes upon consumption, have always been treated and reckoned as falling within the class of indirect taxes, and upon examination of the reasons assigned by writers upon the subject for thus denominating them, it will be found that they are substantially confined to these two reasons, viz.:

1. That usually the persons who primarily pay such taxes do not bear the burden of them, but shift it upon someone else, and that all such taxes, of whatsoever kind, imposed upon the commodity, the processes or manufactures in respect of it, down to the time of its reaching the consumer, enter into the price which he has to pay for the

article, and are thus indirectly paid by him, although he may never directly pay to the tax gatherer any sum whatever in respect of the thing taxed.

2. That in respect of all such taxes upon consumable commodities, the Government exercises no compulsion upon the consumer upon whom the burden of the tax ultimately falls, but that if, or when, he bears the burden, in the shape of enhanced price of the article which he buys and consumes, his subjection to it arises from his own choice or free will, which he exercises in the one way or the other according to his own estimate of what he can or cannot afford to buy or consume, or from such other considerations as he allows to influence him.

In The Theory And Practice Of Taxation, by David Ames Wells, L.L.D.. D.C.L., 1907, p. 549, he said:

"But any doubt on this subject ought no longer to be tolerated, for we now have, almost for the first time, a definition of or distinction between direct and indirect taxes that is founded on sound philosophy and large experience, and can not be refuted - namely, a direct tax has always in it an element of compulsion. The person against whom or on whose property or income a direct tax is levied has no option whether or when he shall pay. There is nothing voluntary about it. On the other hand, an indirect tax, whoever may first advance it, is paid voluntarily, and primarily by the consumer of the taxed article. [Emphasis added]

Constitutional Convention Not a Legislative Body

Reference to the minutes of the debates in the Convention of 1787, which framed the Constitution, as now

found in the Madison papers, so-called, does not appear to afford much, if any, new light, of substantial importance, upon the question under discussion. But in any case, those debates could not be referred to with any substantial effect, because - -

1. That Convention was not at all a legislative body. After devising the proposed Constitution, it merely submitted it to the consideration of the old Congress, with a recommendation, in substance, that thereafter it should be submitted for assent and ratification, to a convention of delegates in each State, chosen under recommendation of its legislature, and that when thus ratified by nine States, proceedings should be had for putting it in operation. The life and efficacy of the Constitution was derived entirely from the action of the States in approving and ratifying it. The Convention which devised or framed it, had not, and did not claim to have, any power to give it vitality.

2. The Convention which devised the Constitution sat with closed doors, a pledge of secrecy was laid on each member, and thus their debates and inside proceedings remained secret until the lapse of many years after the Constitution had been ratified and had gone into effect. Thus the States which had to determine, each for itself, the question of assent and ratification, having before them merely an instrument which had been devised and was submitted to them, could not have been influenced by anything which had occurred in the debates which were at that time shrouded in secrecy.

The history of this matter will be found in McMaster's History of the People of the United States, Vol. 1, p. 418, with an extract as follows:

"The credentials of the delegates were then examined, a committee appointed to prepare rules and an adjournment to the twenty-eighth (May, 1787), taken. *** When Monday, the twenty-eighth (the adjourned day above mentioned) came, nine States

were present, the doors were closed, a pledge of secrecy laid on each member, and from that day forth, what took place in the Convention was never fully known till Madison had been many months in his grave."

And on the same page is the following note:

"Madison's Debates form the only complete record of the discussions in the convention that has come down to us. Judge Yates did indeed take notes which were published after his death. But Yates, with Lansing, lost his temper, quit the Convention in a huff, early in July and never returned. His notes, therefore, cover but a third of the time the Convention sat, and are moreover hasty and crude. Yates was a rank partisan, represented the Clinton party, and when he found he could not carry his point, withdrew. His notes are of doubtful fairness. Madison's Debates were carefully prepared and after his death published by Congress."

Madison died in 1836. Yates, here mentioned, was Robert Yates, afterwards Chief Justice of the Supreme Court of New York. He retired from office by reason of having reached the then constitutional limit of age for judicial service, and died in 1801.

Upon the above mentioned basis of ascertaining the intent as clearly and certainly as may be, let's proceed to discuss the question, what taxes are "direct taxes" within the meaning of the Constitution, so far as is material for determining that a General Tax on Income 1s a direct tax.

The Constitution is to be interpreted by gathering the meaning and Intention of the Convention which framed and proposed it for the adoption and ratification of the Conventions of the people of and in the several States. At the date of the Constitution (1787), the words "direct

taxes" and "indirect taxes" were household words. They were borrowed from the literature and practice of Great Britain and the Continent of Europe. They are to be found in the literature of the period, and in the debates of both Federal and State Conventions. They had been used in Europe as meaning taxes which fell directly upon property and its owner, like a land tax or a tax on incomes, and as meaning taxes of which the ultimate incidence might fall upon another than the one who originally paid them, like taxes upon consumption. The inquiry, therefore, now is whether, when adopted in this country, they carried with them the signification which universally obtained elsewhere, or whether they were accepted with a limited and restricted signification, which confined the meaning of the words to taxes on land and capitation taxes.

There is no persuasive evidence that the American people, in using the words "direct taxes," intended that an income tax should not be included therein. The phrase "income tax" is not to be found in the debates of the Philadelphia Convention, nor, in that precise form, in the debates of the conventions of the several States which adopted the Federal Constitution. But that silence throws no light upon the inquiry whether at that time an income tax was not included in the phrases "direct tax" or "direct taxes" by the American citizens who were then paying such taxes.

A land tax is not mentioned in the Constitution, and, therefore, it is not specified in that instrument as being either a direct or an indirect tax.

The phrase "direct taxes," to find its fulfillment, must of necessity include something more than a capitation or poll tax, which is otherwise provided for, and apply to something other than a single tax, that is, a tax on lands; otherwise the demand of the plural, "taxes," is not fulfilled.

There is no persuasive evidence that in 1787 the species of tax then embraced within the phrase "direct tax" in other countries and in the original States was

intentionally excluded by the framers of the Federal Constitution, and by the citizens of the States which adopted it. History does not warrant the averment that such exclusion was made.

What did the people of the ratifying States understand by the phrases "direct tax" and "direct taxes?" Previous to the adoption of the Constitution there were no Federal taxes, and all precedents for helping to a correct determination of the constitutional meaning of direct taxation must therefore be drawn from the prior experience of the several States. Both the derivative definition and the practical definition afforded by the practice of the States included a tax on income.

Historical research shows that Massachusetts had taxed incomes for more than a hundred years prior to the assembling of the Constitutional Convention; other of the leading States were imposing like taxes at or about 1787, and the receipts therefrom were used to help pay the quotas demanded by the then Government of the Confederation for the maintenance of the Federal Government. The income tax so paid, and all the other internal taxes collected by the States, were known and collected as direct taxes and are so called today.

George Ticknor Curtis, American lawyer, legal writer and constitutional historian, appeared before the United States Supreme Court in many landmark cases, including the Dred Scott case, and the legal tender cases. He wrote an article which was published in Harper's New Monthly Magazine (1866), Revenue Powers of the United States. Vol. XXXIII, pp. 360-361. He stated that the people used terms in the Constitution which were understood by common usage as follows:

HOW SHOULD THE CONSTITUTION BE REGARDED, ON PRINCIPLE?

"By principle, as used in this connection, I mean no reference to theoretical ideas of how the taxing

power of a Government should be arranged; but I include all that reference to terms used, to the known character and purposes of the Government actually established, and to the circumstances on which the Constitution was to operate, that enters into a second canon of interpretation. With respect, then, to the terms employed to describe the subjects of the revenue powers, we shall find very little profit in resorting to the aid of lexicographers, contemporaneous or subsequent. The Constitution was not made to be ratified by a people Mho would be likely to look into dictionaries for the meaning and scope of the terms in which it was expressed. It was a great instrument of fundamental legislation; and the safest rule for its interpretation is to regard the enacting power - the PEOPLE - as using terms in the sense in which they had been accustomed to use them, if they were borrowed from surrounding legislation, or in the sense which the surrounding circumstances show to have been that in which they must have used them for the purpose which they meant to accomplish. This is especially true of the terms which describe the powers conferred upon Congress. Take, for example, the term 'Commerce,' which Congress was to have the power to 'regulate,' as between the State and foreign nations, and among the States. One might look into forty dictionaries, without finding that meaning of the term 'Commerce' which we know from the surrounding circumstances and the historical purpose was intended to be given to this subject of legislative power, and without finding that scope of the term 'regulate' which we know from the same sources was intended to be given to this legislative authority. In the same way, if we would know the meaning in which the people of the United States used the terms 'Taxes, Duties, Imposts, and Excises.' we must go to the sense in which they were

accustomed to use these terms for purposes corresponding to those for which they must have used them in this Constitution; and in this inquiry lexicons, however good, will help us very little, and the definitions of economists as little.

"I assume, then, that when the people of the United States used the terms 'Taxes, Duties, Imposts, and Excises,' they used these terms as they had been accustomed to use them; that they described by them the branches of revenue power which they meant to confer on Congress, in order to enable it to pay the debts and provide for the general welfare of the United States under the Constitution; and that they could have understood no other way of doing this, but to confer on Congress the same kinds of power which their State governments exercised in paying the debts and providing for the general welfare of the States under their local Constitutions. *** It is historically notorious that the people of the States were told that Congress must have the same sources of revenue which the States had hitherto enjoyed; that as to some of these sources the Federal power must be exclusive, that as to all the others it must be concurrent; and that the sole compensations or safeguards that could be given for this vast surrender were to consist in two restraining rules, by which Congress were to be bound in their revenue legislation. As the revenue powers of Congress, therefore, were to be the same as those previously held and exercised by the States, subject to the two restraining rules, it is a just and reasonable inference that the terms of the grant described the subjects of the powers as the people of the States had been accustomed to describe them in their own governments. In that usage the term 'Taxes' had undoubtedly embraced those exactions for public use which the State governments had always assessed upon the citizen.

either in respect of his person or of his property

without any reference to his consumption or diminution or expenditure of the fund from which the assessment was drawn; and the terms Duties, Imposts, and Excises, described those impositions for public use; which they had been accustomed to lay on articles of consumption, and by the operation of which the public takes, and means to take to itself, a part of that which is being consumed. Any one who will look into the legislation and habits of the States, prior to the Federal Constitution, will see that these terms were used in these senses; and that 'Taxes' was not understood to include 'Duties, Imposts, and Excises,' although in a lexigraphical or general sense all public assessments, demanded under authority of law, are Taxes." [Emphasis added]

The powers expressly delegated to the Federal Government were the same kinds of power which the State governments exercised at the time. The direct tax clauses of the Constitution were based upon what the States considered to be direct taxes. This was the only way the people of the respective States could have understood and used the terms "Taxes, Duties, Imposts and Excises."

Chapter III

A GENERAL TAX ON INCOME HAS ALWAYS BEEN RECOGNIZED, DESIGNATED, AND DESCRIBED AS A DIRECT TAX

THE HISTORICAL EVIDENCE

The pertinent literature of the pre-Constitutional period showed that the then American citizens were quite familiar with the relevant English laws and with the writings of political economists. Additionally, they borrowed the phrases "direct tax" and "direct taxes" from the language of the books of the period, and applied them to such taxes as they were then paying in their respective States, both for the support of such States and for the support of the general government under the Articles of Confederation. The Constitutions of the States adopted prior to 1787 indicate that there had been income tax laws passed, by those States, as colonies, for the purpose of assessing and collecting taxes upon incomes, and it was provided that such laws should be carried forward under their new constitutions.

The Beginnings

The first general tax law in the American colonies, with the exception of the early poll-tax in Virginia, was the law of 1634 in Massachusetts Bay. Colonial Records of Massachusetts Bay (Shurtleff's ed., 1853), I, 120. This provided for the assessment of each man "according to his estate and with consideration of all other his abilityes whatsoever." It is probable that the measure of this ability was to be found in property; for, although the law itself does not further explain the term, the matter is elucidated in a provision of the next year, that "all men shall be rated for their whole abilitie, wheresoever it lies." Colonial Records of Massachusetts Bay, I, 166. This seems to imply only visible property; for such property alone is susceptible of a situs.

It was not until several years later that "ability" was defined to include something more than mere property. This, however, occurred not in Massachusetts Bay, but in the colony of New Plymouth. In 1643 assessors were appointed to rate all the inhabitants of that colony "according to their estates or faculties, that is, according to goods, lands, improoued faculties and personall abillities." Records of the Colony of New Plymouth: Laws 1623-1682 (Pulsifer's ed.), XI, 42. The court order of 1646 provided not only for the assessment of personal and real estates, but distinctly mentioned "laborers, artificers and handicraftsmen" as subject to taxation, and then went on and said:

"And for all such persons as by advantage of their arts and trades are more enabled to help bear the public charges than the common laborers and workmen, as butchers, bakers, brewers, victuallers, smiths, carpenters, taylors, shoemakers, joyners, barbers, millers and masons, with all other manual persons

and artists, such are to be rated for returns and gains, proportionable unto other men for the produce of their estates." Colonial Records of Massachusetts Bay. II, 173.

Here for the first time we have the definition of faculty or ability. Just as the faculty of the property owner is seen in the produce of his estate, so that of "artists" and "tradesmen" is to be found in their "returns and gains." Of course, since the property value of an estate is approximately equal to the capitalized value of the annual produce, the faculty of the property owner can be measured by the value of the property, that is, by the value of his "estate"; but when there is no property, the assessors are compelled to fall back on the "returns and gains."

The principle thus laid down in the records of Massachusetts Bay was soon adopted by other colonies. The colony of New Haven, for instance, at first levied a land tax. But as early as 1640 personal property was assessed, by the provision that a new rate should be "estreeted, halfe upon estates, halfe upon lands." Records of the Colony and Plantation of New Haven. I, 40. In 1645 it was seen that even this was not adequate, and a proposal was made to tax others besides property owners; but no decision was reached at that time. Ibid., I, 181. As the dissatisfaction grew, a committee was appointed in 1648 to inquire into the feasibility of the Massachusetts system of taxing all property in general, and also of levying a tax on the profits of those who possessed no property. Ibid., I, 448. The committee reported that they were in doubt as to the advisability of taxing houses and personal property, but that "for tradesmen they thinke something should be done that may be equall in waye of rateing them for their trades." Ibid., I. 494. As a result the law of 1649 was enacted, which introduced the taxation of profits of laborers, tradespeople and others.

In Connecticut the early laws were patterned on the

Massachusetts Bay legislation. It was provided in 1650 that "every inhabitant who doth not voluntarily contribute proportionably to his abillity to all common charges shall be compelled thereunto by assessments and distress"; and it was further provided that the lands and estates should be rated "where the lands & estates shall lye." but "theire persons where they dwell." Colonial Records of Connecticut, I. 548.

In Plymouth Colony the practice inaugurated by the law of 1643 continued, although we find only two more instances where it is expressly mentioned, namely, in 1665, when "visible estates and faculties" were mentioned, (Records of the Colony of New Plymouth (Pulsifer's ed.), XI, 211), and in 1689, when a court order fixed the valuation for different kinds of visible estate, but left the valuation of "faculties and personall abillities" to be determined "at will and doome." Ibid., VI. 221.

In Rhode Island the faculty tax was introduced a little later. In 1673 the assembly laid down the rule that taxes ought to be assessed according to "equety in estate and strength," i.e., not only according to the property, but also in proportion to what was elsewhere called the "faculty," or "profits and gains." Colonial Records of Rhode Island, II. 510.

Outside of New England this early taxation of profits along with the general property tax was found also in New Jersey, where it was provided by the law of 1684 that not only property owners, but also:

"[A]11 other persons within this province who are free men and are artificers or follow any trade or merchandizing, and also all innholders, ordinary keepers and other persons in places of profit within this province, shall be lyable to be assessed for the same according to the discretion of the assessors." Laws of New Jersey, 1664-1701 (Leaming and Spicer), 494.

This completes the list of examples of the faculty tax during the seventeenth century. Later on, it will be seen that, the tax appeared in some of the Southern states. In New York it never secured a foothold. During the Dutch domination, the tax system of this latter colony was composed almost entirely of excises and duties; when the English obtained control, the general property tax was introduced, but without any additional "faculty" tax as in the New England colonies.

These "faculty" taxes were also known as "capitation" taxes which were expressly made "direct taxes" in the Constitution.

The Eighteenth Century

During the eighteenth century the custom of assessing profits continued and extended to other colonies. In Massachusetts more earnest and repeated efforts to explain and enforce the law were made than anywhere else.

Upon the union of the Plymouth and Massachusetts Bay colonies into the Province of Massachusetts, under the charter of 1692, a law was immediately enacted providing that all estates whatsoever, real and personal, should be taxed at "a quarter part of one year's value or income thereof." Acts and Resolves of the Province of Massachusetts Bay. 1692 to 1780 (5 vols.), I, 29. 92.

In 1706, the assessors were admonished to rate:

"[I]ncome by any trade or faculty, which any person or persons (except as before excepted) do or shall exercise in gaining by money, or other estate not particularly otherwise assest, or commissions of profit in their improvement, according to their understanding and cunning, at one penny on the pound, and to abate or multiply the same, if need

be, so as to make up the sum hereby set and ordered for such town or district to pay. Ibid., I, 592. [Emphasis added]

The law of 1738 added the words "business or employment," commanding the assessment of:

"[T]he income or profit which any person or persons (except as before excepted) do or shall receive from any trade, faculty, business or employment whatsoever, and all profits which may or shall arise by money or other estate not particularly otherwise assessed, or commissions of profit in their improvement. ..." Ibid., II, 934.

Except as to the rates, this form of law continued unchanged till 1777. The law enacted in that year gave a fuller interpretation of income than any previously. Taxpayers were assessed:

"[0]n the amount of their income from any profession, faculty, handicraft, trade or employment; and also on the amount of all incomes and profits gained by trading by sea and on shore, and by means of advantages arising from the war and the necessities of the community." Ibid., V, 756. [Emphasis added]

Again, the law of 1779 provided that:

"[I]n considering the incomes and profits last mentioned, the assessors are to have special regard to the way and manner in which the same have been made, as well as the quantum thereof, and to assess them at such rate, as they on their oaths shall judge to be just and reasonable; provided, they do not in any case assess such incomes and profits at more than five times [increased in the next year to

"ten times"] the sum of the same amount in other kind of estate." Ibid., V. 1110. 1163. [Emphasis added]

In 1780, a constitution was adopted which commanded, among other things, that the public charges of government should be assessed "on polls and estates in the manner that has hitherto been practiced." The same methods, therefore, continued to the end of the century.

In none of the other colonies is there found so full or so frequent indications of the legislative intent as in Massachusetts. But occasional references are found to the practice of assessing income. And although it is probable that the custom was gradually dying out, the storm and stress of the Revolutionary period brought it again to the front in several places.

In Connecticut the early laws followed almost word for word the Massachusetts legislation. Later acts provided that:

"[A]11 such persons who by their acts and trades are advantaged shall be rated in the list proportionable to their gains and returns, -butchers, bakers ... and all other artists and tradesmen and shopkeepers." Acts and Laws of Connecticut (New London, 1715), 100. [Emphasis added]

The tax continued in Connecticut to the close of the century substantially unchanged, with the exception that ordinary artisans were subsequently exempted.

In New Hampshire, the first detailed assessment law passed in the province, in 1719, instructed the selectmen to assess the residents "in just and equal proportion, each particular person according to his known ability and estate." Later on. in 1739, "an act for the more easy and speedy assessing" of taxes was passed, which authorized the selectmen to assess "the polls and estates of

inhabitants, each one according to his known ability." Acts and Laws of his Majesty's Province of New Hampshire (1761). 30. 180.

Vermont, when it separated from New York, followed the example of Connecticut in taxation as in much other legislation. The first law on the subject, that of 1778, was very explicit in its provisions, and repeated the Connecticut law in some places word for word. The part of interest was as follows:

"Be it further enacted by the authority aforesaid, that all allowed attorneys at law in this commonwealth, shall be set in the annual list for their faculty. - the least practitioner fifty pounds, and the others in proportion according to their practice; to be assessed at the discretion of the listers of the respective towns where said attorneys live during their practice as such. All tradesmen, traders, artificers, shall be rated in the lists proportionable to their gains and returns; in like manner, all warehouses, shops, workhouses and mills where the owners have particular improvement or advantage thereof, according to the best judgment and discretion of the listers." Hood, History of Taxation in Vermont. 32 and 36. [Emphasis added]

Wood, in his History of Taxation in Vermont, when speaking of these laws, said (p. 39): "It will be observed that the income idea was thus enlarged to suit the growing and diversifying business of the community." Hood also referred to a law passed in 1825, of which he said (p. 46): "The change in practice as to incomes consisted in the revival of minimum assessments."

In Pennsylvania, 1782, a law was enacted which imposed a poll tax on all freemen. But the law went on to say that:

"[A]ll offices and posts of profit. trades, occupations and professions (that of ministers of

the gospel of all denominations and schoolmasters only excepted) shall be rated at the discretion of the township, ward or district assessors, and two assistant freeholders of the proper township, ward or district, having due regard to the profits arising from them." Laws of the Commonwealth of Pennsylvania (Dallas), II. 8.

In 1785 mechanics and manufacturers were added to the list of exempted classes. The discretion which this act left to the assessors was very slight, as the lower and higher limits of the tax were definitely fixed.

Maryland, when the State constitution was adopted in 1777, made provision for an assessment of one-quarter of one per cent on the "amount received yearly" by "every person having any public office of profit, or an annuity or stipend," and on the "clear yearly profit" of "every person practising law or physic, every hired clerk acting without commission, every factor, agent or manager trading or using commerce in this state." Maryland, Laws of 1777, ch. 22, secs. 5, 6.

In South Carolina, 1703, a law provided that individuals should be assessed on their "estates, goods, merchandizes, stocks, abilities, offices and places of profits of whatever kind or nature soever." The law of 1777, which was the first under the State constitution, phrased it a little differently by providing for a tax on "the profits of all faculties and professions, the clergy excepted, factorage, employments, handicrafts and trades throughout this state." Cooper, Statutes at Large of South Carolina. II, 36. 183; IV, 366.

This statute came up for consideration in the case of Savannah v. Hartridge, 8 Ga. — ( ). at page 23, in which the Court said:

"Income is taxable property by the general tax law of that State, and had been, if we mistake not, from the first act upon the subject in 1777. down to

1783, when the charter to the City of Charleston was passed."

In addition to these cases of the taxation of profits as such, there were many cases in which, while the tax was imposed on property, the assessment was made on the basis of product. That is, it was deemed easier to ascertain the profits than the value of property: the property was gauged by the revenue. Thus in Massachusetts in 1692 all estates real and personal were to be rated "at a quarter part of one year's value or income thereof." To make this clearer, it was provided in the following year that "all houses, warehouses, tanyards, orchards, pastures, meadows and lands, mills, cranes and wharffs be estimated at seven years' income as they are or may be let for; which seven years' income is to be esteemed and reputed the value of craftman, for his income." From this time on until the Revolutionary period the valuation of real estate was computed on the income derived from it, but the number of years varied. From 1698 to 1700 the valuation was one year's income, but during most of the eighteenth century it was six years' income. Acts and Resolves of the Province of Massachusetts Bay. I, 29, 92, 413.

We have traced the tax laws of Massachusetts to the law of 1777, which was virtually continued by the new constitution of 1780, and we saw the gradual process by which the term "faculty tax" was displaced both in popular usage and in legal parlance by "income tax." [It must be noted that a "capitation tax" was expressly recognized as a "direct tax" in the Constitution. An income tax differs only in respect to the assessment. One is assessed upon the supposed income (Faculty Tax), or the rank; the other upon the real income (a General Tax on Income). Smith's Wealth of Nations, Vol. 3, pp. 276-278.] No change was made in the wording of the provisions until 1821, when an act was passed which included among the sums to be returned to the assessor:

"[T]he amount of the income of such inhabitants from any profession, handicraft, trade or employment, or gained by trading at sea or on land, and also all other property of the several kinds returned in the last valuation, or liable to taxation by any law. General Laws of Massachusetts, 1831, (3 vols.). vol. ii, laws of 1821, chap. 107, sec. 2. [Emphasis added]

This wording is repeated in the act of 1830, but in this act the term faculty is omitted; and it never reappears in later legislation. In the revised statutes of 1836 another change was made through the omission of the word "handicraft." The section read as follows:

"Personal property shall, for the purpose of taxation, be construed to include ... income from any profession, trade or employment, or from an annuity, unless the capital of such annuity shall be taxed in this state." Revised Statutes of Mass., 1836. chap. 7, sec. 4. [Emphasis added]

A special commission on taxation in Connecticut, referring to the law of 1769, spoke of "our ancient system of incomes taxes." Connecticut Session Laws of 1819, 338.

The law of Pennsylvania passed in 1782 so illustrates the point of the sustainment of the Federal government by a tax to be paid by State citizens occupying offices and posts of profit, trades, occupations and professions, that it is worthy of quotation in full. It is as follows:

"PENNSYLVANIA: An act to raise effective supplies for the year 1782.

SECT. I. - Whereas, the United States of America in Congress assembled, have by their resolution of the thirtieth of October, demanded of the several States in union such effective supplies as may enable them to carry on the war with vigor and effect, and

improve our late success into a full establishment of independence and peace:

And whereas it is the desire of the representatives of the freemen of this State to comply with the said resolutions.

SECT. II. - Therefore, be it enacted, and it is hereby enacted by the Representatives of the freemen of the Commonwealth of Pennsylvania, in General Assembly met, and by the authority of the same, that the sum of 420,297 pounds and 15 shillings, being the quota required of the State, be raised, collected and paid, for the year 1782 in four equal payments.

SECT. III. - And be it further enacted by the authority aforesaid that every single freeman, who at the time of assessing any tax imposed by this act, is or shall be of the age of 21 years or upwards, and has been out of his apprenticeship nine months, shall pay a sum not exceeding six pounds nor under three pounds. And that all offices and posts of profit, trades, occupations and professions (that of ministers of the gospel of all denominations and schoolmasters only excepted) shall be rated at the discretion of the township, ward or district assessors, and two assistant freeholders of the proper township, ward or district, having due regard to the profits arising from them. Passed March 27, 1782. 2 Dallas' Digest, p. 8."

In Delaware, and as Secretary Wolcott said in his Report:

"Taxes have been hitherto collected on the estimated annual income of the inhabitants of the State, without reference to specific objects. It appears to have been a rule established by the assessors, and confirmed by long usage, to assess all persons at one-fifth part of their annual

income." [Emphasis added]

Therefore, we have, prior to the adoption of the Constitution, the States of Vermont, Massachusetts, Connecticut, Pennsylvania, Delaware, New Jersey, Virginia and South Carolina, assessing their citizens upon their profits from their professions, trades and employments, and collecting a tax thereon for the benefit of the states and of the general government. This collection of historical matter shows that at all times, both before and since the adoption of the Constitution, a tax upon incomes has been recognized, designated and described as a direct tax.

In addition to these taxes upon income, nearly all the States imposed poll taxes, taxes on lands, on cattle of all kinds, and various kinds of personal property.

How were all these taxes known to the people of the States at the time when they were paying them? The Century Dictionary says:

"In the United States, all state and municipal taxes are direct, and are levied upon the assessed valuations of real and personal property."

Cooley and the American Cyclopaedia also assert that all states taxes are direct taxes. "Taxes are usually divided into direct and indirect; the former include assessments made upon the real and personal estate of the taxpayer upon his income or upon his head. New Am. Cyclop.

Dr. Lieber, referring to the different modes of levying taxes, said:

"The first way is to direct; to determine from the statement of the parties concerned, or from official information, the net income of persons. This kind of tax is called direct. 7 Encyclopedia Americana, p. 155. [Emphasis added]

But there is more persuasive evidence as to what kind of taxes the people at the time called those which they were paying in the states for the joint support of the states and of the general government. In the Massachusetts' Convention, Mr. Dawes said:

"Congress had it not in their power to draw a revenue from commerce, and therefore multiplied their requisitions on the States. Massachusetts, willing to pay her part, made her own trade law, on which the trade departed to such of our neighbors as made no such impositions on commerce; thus we lost what little revenue we had, and our only course was, to a direct taxation". 2 Ell. Deb., 41. [Emphasis added]

Mr. Nicholas, in Virginia, said:

"Nine-tenths of the revenues of Great Britain and France are raised by indirect taxes; and were they raised by direct taxes, they would be exceeding oppressive. At present the reverse of this proposition holds in this country, for very little is raised by indirect taxes. The public treasuries are supplied by means of direct taxes, which are not so easy for the people." 3 Ell. Deb., 99. Emphasis added]

Mr. Iredell, of North Carolina, said:

"Our state legislature has no way of raising any considerable sums but by laying direct taxes. Other states have imports of consequence. This may afford them a considerable relief; but our State, perhaps, could not have raised its full quota by direct taxes without imposing burdens too heavy for the people to bear." 4 Ell. Deb., p. 146. [Emphasis added]

See, The genuine information delivered to the Legislature of the State of Maryland, relative to the proceedings of the General Convention held at Philadelphia in 1787, by Luther Martin, Esq., Attorney-General of Maryland, and one of the delegates in the said Convention, "from which it appears that direct taxation was 'either a capitation on their heads or an assessment on their property.'" Ibid., 1, p. 368.

Gouverneur Morris, in his observations on the Finances of the United States, said, two years after the Constitution was adopted:

"There is a concurrent jurisdiction respecting internal or direct taxes."

In his Report to Congress, in 1812, Albert Gallatin said:

"The direct taxes laid by the several states during the last years of the Revolutionary War, were generally more heavy than could be paid with convenience; but during the years 1785 to 1789, an annual direct tax of more than two hundred thousand dollars was raised in Pennsylvania, which was not oppressive, and was paid with great punctuality."

Although the framers of the Constitution and the people they represented might not fully agree as to a full and comprehensive definition of a direct tax, there was a perfect unanimity of opinion among them that an income tax was a typical example of that kind of taxation.